Thursday, May 25, 2006

The Truth About Taxes and Revenue

For the past twenty-five years, the American conservative movement has been gaining ground. During that time, there have been many lies told in an effort to garner votes. One of the greatest of those lies has been that tax cuts lead to greater government revenues. The premise is that if people pay less taxes, they will have more money to spend thereby creating a more robust economy and this will lead to more revenue for the government by way of increased spending. Some call it "supply side economics." Reagan called it "trickle-down economics." George H.W. Bush called it "voodoo economics." You can call it what you like, the simple fact is, it does not work.

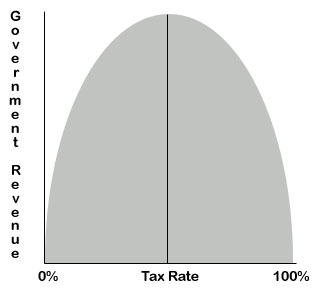

The entire premise is based on a sketch on a napkin that has come to be known as the Laffer Curve. It looks something like this:

As crude as the animation is, it demonstrates the concept. According to Arthur Laffer, the napkin sketcher, there is a specific percentage of taxation that will yield maximum revenue for the government. The problem is that this concept is not based on any actual data. In fact, it's only based on the assumption that taxes are to the right of their optimum level and unfortunately for conservatives, the real numbers don't support their assumption.

The hero of the modern conservative movement is, of course, Ronald Reagan, the tax cutter extraordinaire. According to the Laffer-disciples, it was Reagan's 1981 tax cuts that spawned the booming economy of the eighties. (I remember the eighties very clearly and I know for a fact that my family struggled financially throughout the decade, but that's another story.) But what conservatives don't like to acknowledge is the fact that Reagan's economy didn't take off until he began raising taxes. The tax increases started in 1982, but things really got moving with the 1984 Deficit Reduction Act, and continued with the 1985 Consolidated Omnibus Budget Reconciliation Act, the 1986 Tax Reform Act, and the 1987 Omnibus Budget Reconciliation Act. From 1981 to 1984, the years most affected by the tax cut, tax revenue was $286 billion, $298 billion, $289 billion and $298 billion respectively. On the other hand, from 1985 to 1988, the respective tax revenues were $335 billion, $349 billion, $392 billion, and $401 billion. A significant increase over the previous four years. The only way the Laffer curve could justify this outcome is if the tax rate was already to the left of that optimum point. If that were the case, why cut taxes further?

Now fast-forward to the year 2001. George W. Bush has cut taxes twice since taking office. The first time in 2001 and the second time in 2003. What's happened since then, you ask? In 2001, the tax revenues equaled $994 billion and in 2005 they equaled $927 billion. That's a decline of 6.7%. To make matters worse, in spite of a 6.7% decline in government revenue, the administration has increased discretionary spending by nearly 50% from $649 billion to $967 billion over the same time period. How's that for fiscal conservatism?

The Laffer curve has continuously proven itself to be unreliable, but that hasn't stopped conservatives from lauding its value in an attempt to mislead the public. Lower taxes sounds like a great idea, sure. But when it comes at the expense of the country's well-being, is it really that great?

By the way, irony of all ironies, guess who was present in the meeting the day Arthur Laffer drew the now infamous sketch on that napkin. Old Five-deferment Cheney, himself. This man's like a bad penny. He just keeps turning up everywhere.

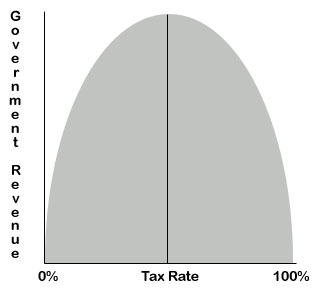

The entire premise is based on a sketch on a napkin that has come to be known as the Laffer Curve. It looks something like this:

As crude as the animation is, it demonstrates the concept. According to Arthur Laffer, the napkin sketcher, there is a specific percentage of taxation that will yield maximum revenue for the government. The problem is that this concept is not based on any actual data. In fact, it's only based on the assumption that taxes are to the right of their optimum level and unfortunately for conservatives, the real numbers don't support their assumption.

The hero of the modern conservative movement is, of course, Ronald Reagan, the tax cutter extraordinaire. According to the Laffer-disciples, it was Reagan's 1981 tax cuts that spawned the booming economy of the eighties. (I remember the eighties very clearly and I know for a fact that my family struggled financially throughout the decade, but that's another story.) But what conservatives don't like to acknowledge is the fact that Reagan's economy didn't take off until he began raising taxes. The tax increases started in 1982, but things really got moving with the 1984 Deficit Reduction Act, and continued with the 1985 Consolidated Omnibus Budget Reconciliation Act, the 1986 Tax Reform Act, and the 1987 Omnibus Budget Reconciliation Act. From 1981 to 1984, the years most affected by the tax cut, tax revenue was $286 billion, $298 billion, $289 billion and $298 billion respectively. On the other hand, from 1985 to 1988, the respective tax revenues were $335 billion, $349 billion, $392 billion, and $401 billion. A significant increase over the previous four years. The only way the Laffer curve could justify this outcome is if the tax rate was already to the left of that optimum point. If that were the case, why cut taxes further?

Now fast-forward to the year 2001. George W. Bush has cut taxes twice since taking office. The first time in 2001 and the second time in 2003. What's happened since then, you ask? In 2001, the tax revenues equaled $994 billion and in 2005 they equaled $927 billion. That's a decline of 6.7%. To make matters worse, in spite of a 6.7% decline in government revenue, the administration has increased discretionary spending by nearly 50% from $649 billion to $967 billion over the same time period. How's that for fiscal conservatism?

The Laffer curve has continuously proven itself to be unreliable, but that hasn't stopped conservatives from lauding its value in an attempt to mislead the public. Lower taxes sounds like a great idea, sure. But when it comes at the expense of the country's well-being, is it really that great?

By the way, irony of all ironies, guess who was present in the meeting the day Arthur Laffer drew the now infamous sketch on that napkin. Old Five-deferment Cheney, himself. This man's like a bad penny. He just keeps turning up everywhere.